Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.

Beyond the Cove - Problem Solving, UK Homes, and Pyramid Calcs

|

Welcome. 👋 Every two weeks, I share my writing on investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm still trying to figure stuff out. Don't miss the new "How We Can Work Together" section at the end. Was this newsletter forwarded to you? See past articles and subscribe here. Problem-SolvingOver the past several weeks, I've gathered feedback on a new idea from Cove's investors and other partners. It's been energizing to reconnect with so many thoughtful friends and colleagues. On the one hand, I was excited about a new strategy for acquiring smaller, overlooked properties—a niche that could be incredibly lucrative. On the other hand, I knew that the lack of fee income from these deals seriously challenged my financial stability. How could I pursue meaningful, fulfilling work while still generating enough current income to support my family? Fortunately, I'm now closer to some answers. Our work involves many facets and complicating elements. It's not only about the tasks we perform; work becomes the conduit through which we make friends, express our creativity, and hone our unique skills. Through work, we learn and love. In fact, I'm one of many who met their spouse at the office. Work can be a positive vehicle for personal growth and engagement, but we must be careful. Work also has a dark side. Unchecked, it can, and often will, consume us. As David Whyte reminds us in The Three Marriages, "Work, like marriage, is a place you can lose yourself more easily, perhaps than finding yourself. It is a place full of powerful undercurrents, a place to find our selves, but also, a place to drown, losing all sense of our own voice, our own contribution and conversation." And yes, there's a very practical aspect to work. Work pays for the roof over our heads, puts food on the table, and provides access to healthcare. In my experience of career transitions, I've found it helpful to separate the personal (growth, curiosity, relationships, contribution…, etc.) from the practical (income, benefits…, etc.). Both areas matter and deserve consideration when charting career paths. However, why must one job address both? Sometimes, a bit of creativity may be warranted. Specifically, here's the challenge I'm currently facing: How can I do meaningful and fulfilling work through Cove that will also benefit investors and society while generating enough income to support my family? To show further, I'll describe the challenge in more detail. At Cove, I'm excited about a new strategy to acquire smaller properties (5-19 units) in the DC market. These smaller properties tend to be less competitive and poorly managed. They're too large for individuals and too small for institutions - smaller deals generate smaller fee dollars, so it's not worth the time for larger firms. That's precisely why professional investors overlook this massive niche and why the opportunity could be more lucrative. (by the way - hit reply if you want to learn more). If all goes as planned, Cove investors will do well over time. However, the lack of fee income (remember, smaller fees on smaller deals) still poses a problem for me in the near term. Even if I don't have to pay a team of analysts or buy expensive ad space, I still need to pay the bills. Dead end? Not necessarily. There may be a better solution. But to get there, we must separate the personal from the practical. As I thought more about it, I started to build a list of ways to address the desire to execute my acquisition strategy while generating enough current income. Here are some initial ideas and comments:

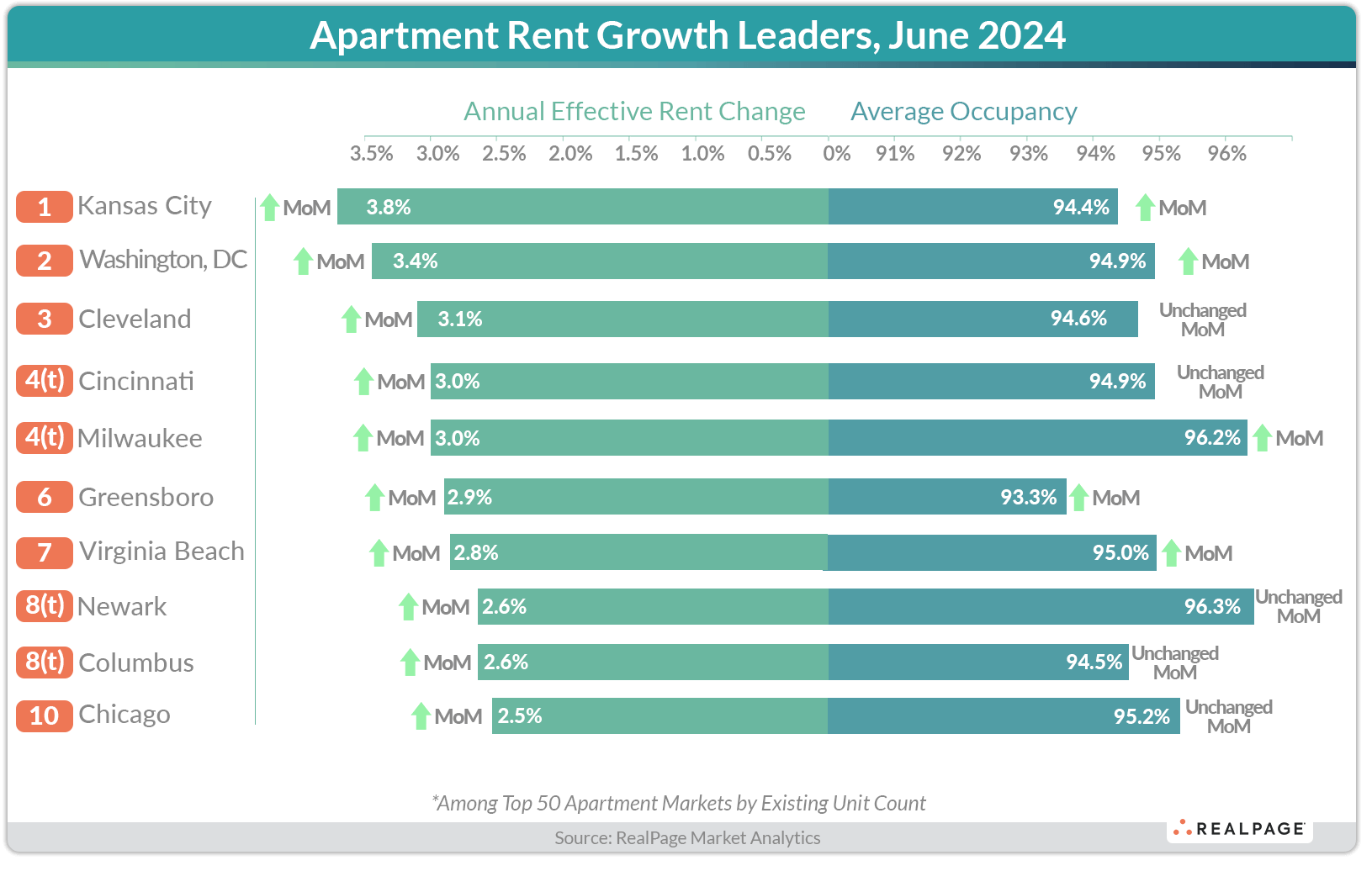

There are undoubtedly other ideas (please share if something comes to mind), but you get the point. By showing examples of my thought process, I hope you can see the value in separating the personal from the practical elements associated with work. With some creative solving, we can have our cake and eat it, too. Design thinking can be a helpful reference here, as it encourages us to frame problems creatively and iteratively seek solutions. The challenge is balancing the personal and practical aspects of our professional lives. By addressing the income challenge head-on, we can create a sustainable path that allows us to continue pursuing meaningful work without compromising our financial stability. As for my dilemma, I’m approaching a solution that should address my personal and practical needs. I’m excited and would love to share more. You know where to find me. Just hit reply. Other StuffU.S. Apartment Demand Surges in 2nd Quarter Apartment demand in the U.S. surged in Q2, with 390,000 units absorbed over the past year. Despite strong demand, supply continues to outpace demand, leading to stabilized occupancy rates and modest rent growth.

Read the blog post (3 mins) Housing the Young As a former UK housebuilding analyst, I see many parallels with US housing markets. If US first-time homebuyer affordability is stretched, you should look over the pond to see where things may be heading. It's not pretty. Marc Rubinstein's full Net Interest essay is behind the paywall, but you'll get the idea. When I bought my first home, in a trendy part of London over 25 years ago, house prices in the capital were four times median income. Today, the multiple is 12 times. Having taken me two years of toil in the City to save for a deposit, it takes current workers 30 years. That makes no sense. Across the UK, houses haven’t been this expensive

relative to earnings since 1876.

Read the article (9 mins) How Many Workers Did It Take to Build the Great Pyramid of Giza? Now, I realize this post only excerpts a story in Vaclav Smil's Numbers Don’t Lie, which I haven't read YET. But it's still pretty neat how they calculate the estimate. It reminded me of the mind-bending comparison that Cleopatra, who died around 25 BCE, lived closer to the moon landing than she did to the construction of the Great Pyramids (~25th century BCE). 🤯 Read the post (2 mins) And a Farewell Photo...How We Can Work TogetherHi, I’m David. This newsletter is my passion project, connecting with thoughtful people like you. I spent 25 years in institutional equities as an analyst, portfolio manager, and salesperson. In 2022, I joined Circa, a seed-stage rent payment startup, as COO. I left Circa in 2024 as part of our successful exit to Stake, a larger private company in the proptech space. Here are two ways we can work together:

To learn more, click here to schedule a one-on-one call to see if we're a good fit. |

Hi! I'm David.

Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.