Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.

Beyond the Cove - More Rope, Mainstream Alts, and Doing Deficit

|

Welcome. 👋 Every two weeks, I share my writing on investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm still trying to figure stuff out. Was this newsletter forwarded to you? See past articles and subscribe here. Let's Work TogetherI continue to explore several possible paths for what comes next professionally. The job search process could hardly be called fun. Still, I've also enjoyed dozens of valuable conversations with thoughtful friends, former colleagues, and thinking partners in my network. Recently, I've focused on testing a new business idea I call Cove Advisory. This business would initially provide support services to a small handful of emerging managers, RIAs, and family offices on a flexible basis. Think fractional COO that enables principals to prioritize investing and client work. Based on many conversations, I know smaller, fast-growing firms want and need this service. But I don’t know yet if they’re willing to pay for it at a rate that supports a business. We'll see. At the same time, I’m discussing full-time roles where I might impact organizations by leveraging my skills and experience. And in case you’re wondering, I’m not only open to spending time in the office, I’m excited to do so. I love speaking with new people and helping others if I can. If you think there’s someone I should meet, I welcome an introduction. For more, see the updated "How We Can Work Together" section at the bottom of this email. More RopeI was having a great week in my job search. And then, on Wednesday morning, LinkedIn decided I might have a promising future in fast food management. There it was, served up hot: "Closing Shift Manager (one weekend day a must)” at McDonald's in Kittery.

Hmmmm. I mean… at least hook me up at Wendy’s. And then, for a moment, a flash of self-doubt struck. What if I don’t find a better opportunity? Then what? The feeling, however fleeting, hit hard. A sense of scarcity took over, and I desperately wanted this transition phase to be over. Then, a deep breath. And a reset. Fortunately, the wave passed as quickly as it arrived. Plus, I haven’t completely lost my sense of humor. So I smiled, deleted the alert, and got back to work. Or, more accurately, I got back to networking, which has been an unequivocally positive experience so far. I’ve maintained a regular cadence of calls and in-person meetings. This day was packed with several opportunities to connect with others. An hour later, I left my house to meet Dave Lundgren, my friend and former client, for lunch in his hometown, about two hours away. With a bit of time in between calls, I queued up one of Dave’s podcasts to prime our conversation. In addition to running a hedge fund and publishing a technical investing research product, Dave co-hosts a podcast called “Fill the Gap.” The podcast is an opportunity to interview leading investors and strategists from the world of technical analysis. I played Episode 38, a conversation between Dave and Frank Teixeira, Dave’s former colleague at Wellington Management. As they described how their investing approaches have evolved, their comments about managing volatility and risk management struck a nerve. In recent years, Dave and Frank both acknowledged a willingness to "give stocks more rope." In other words, they’ve become more patient in their sell discipline to avoid overreacting to short-term price moves. Dave stresses the same point in one of his recent MOTR Minute videos shown below. Individual stock price volatility is normal and inevitable. While seeing your holdings decline is unsettling, these fluctuations are often just background noise. Short-term price drops don't always indicate a poor investment decision. It’s well understood that investors must endure temporary emotional and financial discomfort caused by volatility to long-term gains in the stock market. At that moment, it struck me that, to use their words, I needed to be more comfortable giving my job search “more rope.” The natural ups and downs—false leads, self-doubt, financial cost—all add to the temptation to make a quick decision. But, just like in investing, discipline and process are essential. To be clear, ideal outcomes are never guaranteed. But the commitment to accepting the inevitable pain and stress of uncertainty is what opens the door to real fulfillment. You’ve got to stay in the game. As I continue my career search, I'm trying to embrace patience. It's not always easy, but I'm learning that the art of letting things unfold naturally might just be the key to finding the next right thing. And if worse comes to worst, I hear there’s an opening for a night manager at the Golden Arches. Other StuffAGM Alts Weekly Thanks to "FL" for introducing me to this weekly newsletter focused on alternative investments. AGM is shorthand for Alt Go Mainstream, the insightful (and free!) newsletter by Michael Sidgmore, partner and co-founder at Broadhaven Ventures. I haven't found a more comprehensive resource that chronicles the seismic shift toward institutional quality alternative assets ongoing in the investment business. Michael's related podcast is also well done. Start with this conversation with Bernstein Private Wealth Management’s CIO Alex Chaloff.

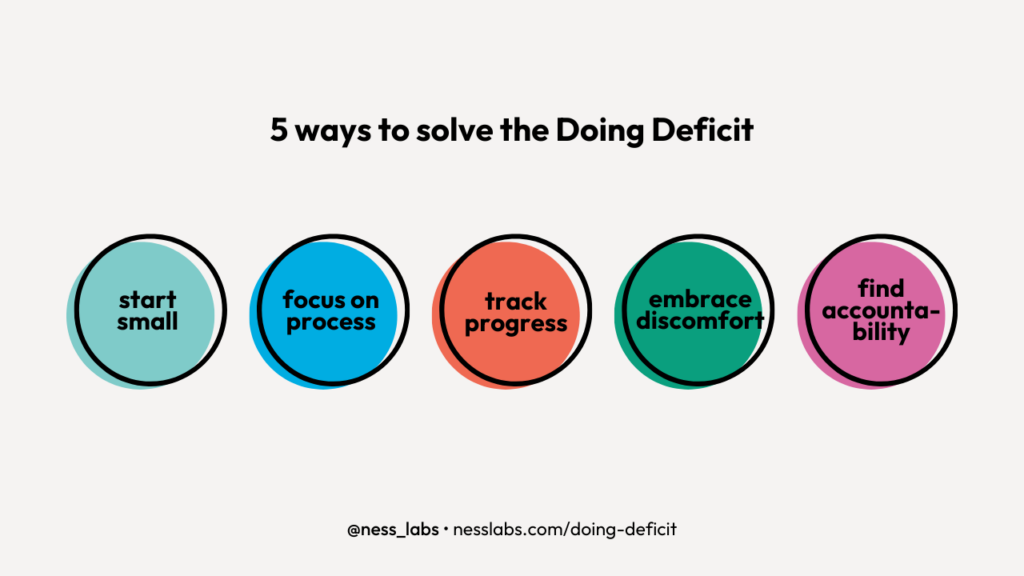

Check out the weekly newsletter (15 minutes) Creating a Personal Masterplan Josh Kaufman, author of The Personal MBA, emphasizes the importance of identifying your core priorities and systematically working towards your goals. The piece includes lots of tactical advice rather than platitudes. Focusing on key areas and taking daily actionable steps can maintain momentum and motivation while regularly revisiting your plan to ensure you stay aligned with your long-term aspirations. Read the post (9 mins) The Doing Deficit: How Deliberate Action Outperforms Passive Learning This essay by Ness Labs founder Anne-Laure Le Cunff offers valuable insights into the importance of active engagement in the learning process. She recommends shifting our focus from mere contemplation to deliberate practice to bridge the gap between knowledge and action. In short, progress is about less reading and more doing.

Read the essay (5 minutes) And a Farewell Photo...How We Can Work TogetherHi, I’m David. This newsletter is a passion project that helps me stay connected with thoughtful people like you. I spent 25 years in institutional equities as an analyst, portfolio manager, and salesperson. In 2022, I joined Circa, a seed-stage rent payment startup, as COO. I left Circa in 2024 as part of our successful exit to Stake, a larger private company in the proptech space. Also, since 2019, through Cove Investments, I've been an active multifamily real estate investor for myself and on behalf of others. Here are three ways we can work together:

To learn more about any of the above, click to schedule a one-on-one call to see if we're a good fit. |

Hi! I'm David.

Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.